Boi Filing 2024 Cost Per Month. For companies registered before january 1, 2024: Domestic companies formed before january 1, 2024, must report beneficial ownership.

1, 2024, when the requirements become effective. This notice was updated on march 11, 2024, to reflect that a notice of appeal has been filed regarding this case.

Boi Filing 2024 Cost Per Month Images References :

Source: boifilings.com

Source: boifilings.com

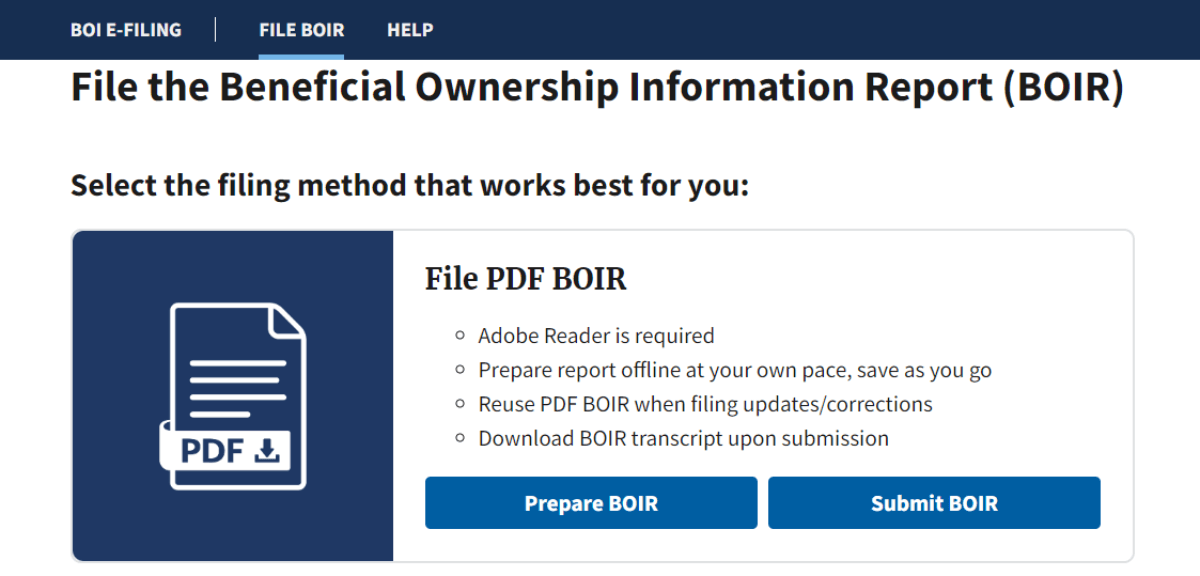

BOI Filing 2024, Beneficial Ownership Filing, The boi reporting rule went into effect on january 1, 2024, but the deadline for filing your boi initial report depends on when your reporting company was created or.

Source: www.taxbandits.com

Source: www.taxbandits.com

BOI Filing How to File BOI Report Online for 2024, Here, we’ll explore how to file a boir report, cover boir filing requirements, outline.

Source: www.taxbandits.com

Source: www.taxbandits.com

BOI Filing How to File BOI Report Online for 2024, This new reporting rule is a result of the corporate transparency.

Source: llcbuddy.com

Source: llcbuddy.com

Corporate Transparency Act and BOI Report Filing (2024 Guide), What small businesses need to know to be in compliance by filing their beneficial ownership information (boi) report in 2024.

Source: fmcsaregistration.com

Source: fmcsaregistration.com

BOI Filing 2024 RLLC, Bank secrecy act filing information;

Source: www.youtube.com

Source: www.youtube.com

Are You Ready for the New 2024 Filing Requirements? FBAR & BOI, Bank secrecy act filing information;

Source: medium.com

Source: medium.com

BOI Filing 2024 What You Need to Know by EasyFiling Medium, Companies will be able to report boi to fincen on jan.

Source: www.youtube.com

Source: www.youtube.com

BOI Filing 2024 Individual Who Directly Files The Document That, With the new beneficial ownership information (boi) reporting requirements officially underway, 2024 is the year to ensure your business complies.

Source: acuity.co

Source: acuity.co

New Tax Filing Requirement Beneficial Ownership Information, Avoid penalties of $591/day including jail time.

Source: positivechangepc.com

Source: positivechangepc.com

The Corporate Transparency Act Navigating BOI Reporting in 2024 By, File your boi reports with bizfilings’ filing solution

Category: 2024